Oscillators and Momentum Indicators: Understanding Their Significance in Technical Analysis

Introduction

When it comes to analyzing financial markets, technical analysis plays a crucial role in helping traders make informed decisions. Oscillators and momentum indicators are two key tools used in technical analysis that provide valuable insights into market trends, reversals, and potential entry or exit points. In this article, we will delve into the significance of oscillators and momentum indicators and how they can be effectively used in trading strategies.

What are Oscillators?

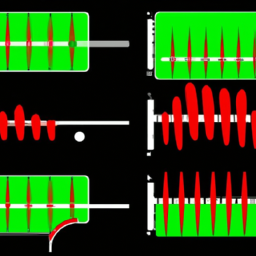

Oscillators are technical indicators that help traders identify overbought or oversold conditions in the market. They oscillate between predefined levels, indicating the strength and momentum of a particular trend. Oscillators are typically displayed as graphs or lines below the price chart and are used to generate buy or sell signals.

Types of Oscillators

There are various types of oscillators used in technical analysis, including:

- Relative Strength Index (RSI): RSI measures the speed and change of price movements. It ranges from 0 to 100, with readings above 70 indicating overbought conditions and readings below 30 indicating oversold conditions.

- Stochastic Oscillator: The stochastic oscillator compares the closing price of an asset to its price range over a specific period. It oscillates between 0 and 100, with values above 80 suggesting overbought conditions and values below 20 suggesting oversold conditions.

- Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum oscillator that measures the relationship between two moving averages. It consists of a MACD line, a signal line, and a histogram. Crossovers and divergences between the lines are used to generate trading signals.

Understanding Momentum Indicators

Momentum indicators, as the name suggests, measure the velocity at which prices are changing. They help traders identify the strength and speed of a trend, as well as potential trend reversals. Momentum indicators are usually displayed as lines or histograms below the price chart and are used to confirm the strength of a trend.

Types of Momentum Indicators

Some common momentum indicators used by traders include:

- Relative Strength Index (RSI): RSI can also be classified as a momentum indicator. It measures the speed and change of price movements, indicating whether an asset is overbought or oversold.

- Moving Average Convergence Divergence (MACD): MACD, in addition to being an oscillator, is also a momentum indicator. It shows the relationship between two moving averages and helps identify the strength of a trend.

- Rate of Change (ROC): ROC calculates the percentage change in price over a specified period. It helps traders identify the speed of price movements and potential trend reversals.

Using Oscillators and Momentum Indicators in Trading Strategies

Oscillators and momentum indicators are valuable tools for traders to confirm trends, identify overbought or oversold conditions, and generate buy or sell signals. Here are some ways to use them in trading strategies:

- Identify overbought and oversold conditions: Oscillators such as RSI and stochastic can help traders identify when an asset is overbought or oversold, indicating potential reversals.

- Confirm trend strength: Momentum indicators like RSI and MACD can be used to confirm the strength of a trend. If the price is rising, but the momentum indicator is showing a divergence or weakening, it may suggest a potential trend reversal.

- Generate buy or sell signals: Oscillators and momentum indicators often generate buy or sell signals based on crossovers, divergences, or specific levels. Traders can use these signals to enter or exit positions.

Conclusion

Oscillators and momentum indicators are essential tools in technical analysis that provide valuable insights into market trends, reversals, and potential entry or exit points. By understanding and effectively utilizing these indicators, traders can enhance their decision-making process and improve their trading strategies. However, it is important to note that no indicator is foolproof, and it is advisable to use them in conjunction with other technical analysis tools and risk management practices.