Mastering Support and Resistance Trading Strategies

Trading based on support and resistance levels is a method used by countless traders across various markets. This technique revolves around the concept of identifying price levels on charts where an asset’s price movement is likely to pause or reverse. These key levels act as barriers, within which traders can make informed decisions to enter or exit trades. In this article, we’ll delve into what support and resistance are and how you can employ strategies around these concepts to potentially improve your trading outcomes.

Understanding Support and Resistance

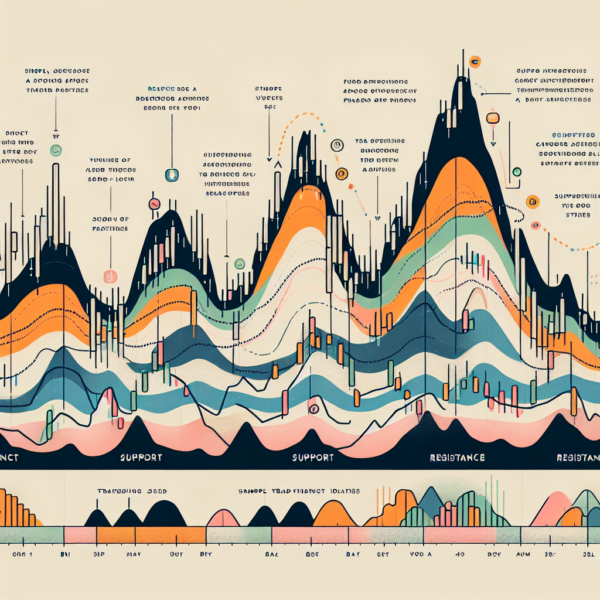

Before diving into strategies, it’s crucial to grasp the basic concepts of support and resistance. Support is a price level where a downtrend can be expected to pause due to a concentration of demand. As the price of an asset drops, demand increases, forming the support line. Conversely, resistance is the point where an uptrend is likely to halt due to a surge in supply, marking a price ceiling. These levels are foundational for traders to pinpoint entry and exit points based on historical price movements and pattern formations.

Identifying Support and Resistance Levels

1. Swing Highs and Lows

Observing chart patterns and looking for peaks (swing highs) and troughs (swing lows) can help identify potential resistance and support areas. Traders often draw horizontal lines at these levels to mark where the price might face obstacles.

2. Moving Averages

A moving average smoothens out price data to create a single flowing line, making it simpler to ascertain the direction of the trend. This line can act as dynamic support or resistance, where the price tends to bounce off the moving averages.

3. Trendlines

By connecting a series of highs or lows with a straight line, you can create a trendline that acts as dynamic support or resistance. These trendlines can be upward, downward, or horizontal and help in predicting future price movements.

Strategies for Trading Support and Resistance

Trading on Bounces

The idea here is to enter a trade on the assumption that the price will rebound off the support or resistance level. Traders wait for the price to approach a well-established support or resistance level and enter a trade betting on the price bouncing back.

Trading on Breakouts

Sometimes, a price will break through a support or resistance level, indicating a potential strong movement in the direction of the break. In this strategy, traders enter a trade when the price moves beyond a support or resistance level with increased volume, aiming to catch the momentum before it dies down.

Risk Management in Support and Resistance Trading

While trading based on support and resistance levels can be powerful, it is not without risk. It’s essential to employ proper risk management techniques to safeguard your capital. This can include setting stop-loss orders slightly beyond the support or resistance level to minimize potential losses and only allocating a small percentage of your trading capital to any single trade. Additionally, patience is key. Waiting for confirmation of a bounce or breakout before entering a trade can prevent jumping in on false signals.

Conclusion

Support and resistance trading strategies are pivotal for traders looking to capitalize on the market’s natural ebbs and flows. By understanding how to identify these critical levels and implementing strategies tailored to trading bounces and breakouts, traders can enhance their trading acumen. However, like any trading strategy, success lies in disciplined risk management, continuous learning, and adapting to market conditions. As you gain experience, you’ll become more adept at spotting these opportunities and navigating the complexities of market trading.