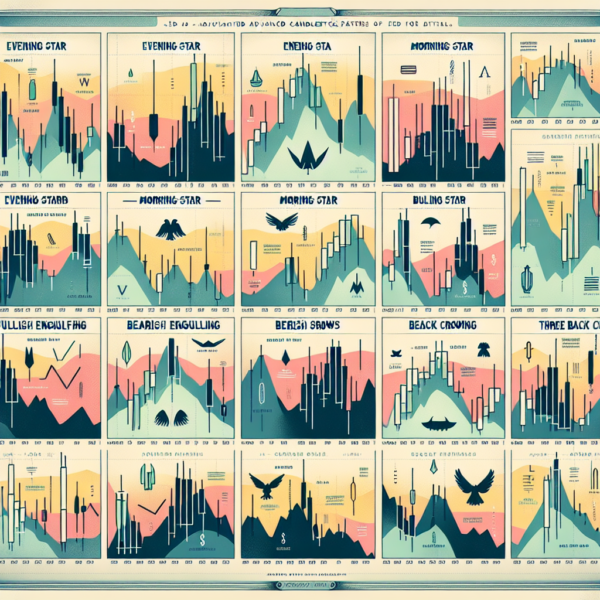

Introduction to Advanced Candlestick Patterns

Candlestick patterns are integral to technical analysis, offering deep insights into market sentiment and potential price movements. While basic patterns provide a foundation for understanding market dynamics, advanced candlestick patterns offer a more nuanced view, enabling traders to make more informed decisions. These patterns, often involving more candles and requiring specific conditions to form, can signal continuations or reversals in market trends. In this article, we delve into some of the most powerful advanced candlestick patterns that traders should be familiar with.

Three-Line Strike

The Three-Line Strike pattern is known for its high accuracy in predicting trend reversals. It consists of three consecutive bearish candles in a downtrend, each closing lower than the previous, followed by a bullish candle that opens lower but closes above the first candle’s open. This pattern suggests a strong buy signal as bears lose control and bulls take over with significant force.

Identification of Three-Line Strike

- The first three candles should be long and bearish, each closing lower than the previous.

- The fourth candle is bullish, opening at or below the third candle’s close but closing above the first candle’s open.

Evening and Morning Stars

The Evening Star and Morning Star patterns signify potential reversals in the market. The Evening Star, indicating a shift from a bullish to a bearish trend, consists of a large bullish candle, a gap up followed by a small-bodied candle, and a large bearish candle that closes well into the body of the first candle. Conversely, the Morning Star pattern suggests a move from bearish to bullish momentum through a large bearish candle, a gap down with a small candle, and a large bullish candle closing within the body of the first candle.

Trading the Morning Star Pattern

- Confirmation: Wait for the third candle to complete to confirm the reversal signal.

- Entry Point: Consider opening a long position after the third candle closes, indicating a shift in momentum.

- Stop-Loss: Set a stop-loss below the low of the Morning Star pattern to limit potential losses.

Trading the Evening Star Pattern

- Confirmation: Ensure the third candle of the pattern has concluded to validate the reversal.

- Entry Point: Opening a short position after the completion of the third candle can capitalize on the impending downtrend.

- Stop-Loss: A stop-loss above the high of the Evening Star pattern can help manage risk effectively.

Bearish and Bullish Engulfing

The Engulfing patterns, either Bearish or Bullish, are pivotal for identifying potential reversals. A Bearish Engulfing pattern occurs at the end of an uptrend, featuring a small bullish candle fully engulfed by a subsequent large bearish candle. This pattern signals a strong sell as it denotes bear dominance. On the flip side, the Bullish Engulfing pattern emerges at the end of a downtrend, displaying a small bearish candle completely engulfed by a larger bullish candle, indicating a powerful buying opportunity.

Identifying Engulfing Patterns

- Bearish Engulfing: Spot at the peak of an uptrend; the second, larger bearish candle must fully engulf the body of the preceding bullish candle.

- Bullish Engulfing: Find at the trough of a downtrend; ensure the second, larger bullish candle completely covers the first bearish candle’s body.

Conclusion

Advanced candlestick patterns, including the Three-Line Strike, Evening and Morning Stars, and Engulfing patterns, offer invaluable insights and help traders anticipate market turns with higher precision. Mastery of these patterns requires practice and patience, but the potential rewards for your trading strategy can be substantial. As always, it’s critical to use these patterns in conjunction with other technical analysis tools and fundamental analysis to validate your trading decisions.