News: Unbiased 2024 Reviews of Financial Services & Products - Valifind.com

Mastering Risk Management with Technical Analysis

Risk Management Using Technical Analysis Investing in the financial markets can be a lucrative endeavor, yet it comes with its share of risks. To mitigate these risks, investors employ various strategies, with technical analysis standing out as a pivotal tool for many. By understanding and applying technical analysis effectively, investors can manage their risk and safeguard their investments agai...[Read More]

User Feedback on Mobile Trading Apps: An In-Depth Analysis

Introduction to Mobile Trading Apps In our increasingly mobile-centric world, trading apps have revolutionized the way individuals participate in the stock market. These applications allow users to buy, sell, and manage investments directly from their smartphones, offering unprecedented convenience and accessibility. However, as with any technology, user feedback plays a crucial role in shaping th...[Read More]

Understanding the Dynamics of the Global Debt Market

# Debt Market Analysis: Understanding the Pulse of Global Finance The debt market, often referred to as the bond market, plays a crucial role in global finance, acting as a mechanism for governments, corporations, and other entities to borrow money and for investors to earn a return. This article delves into the intricacies of the debt market, analyzing its current trends, future outlook, and the ...[Read More]

Top Forex Brokers Offering Fast Execution Speeds

Forex Brokers with Fast Execution Speeds In the world of online forex trading, the speed of order execution is a critical factor that can significantly influence trading outcomes. Fast execution speeds ensure that traders can enter and exit the market at their desired prices, even in volatile conditions. This article highlights forex brokers known for their lightning-fast execution speeds, which i...[Read More]

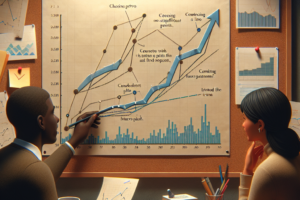

Mastering Trend Line Drawing: A Comprehensive Guide

# Trend Line Drawing Methods: An Insightful Guide Drawing trend lines is a fundamental skill in technical analysis that helps traders and investors identify the direction of the market trend. This practice can pinpoint support and resistance levels, enabling better decision-making. This article explores various trend line drawing methods, focusing on why they are crucial in market analysis. Unders...[Read More]

The Evolution of Cryptocurrency Adoption Worldwide

# Cryptocurrency Adoption News: A Growing Digital Currency Landscape The world of digital currency is evolving at an unprecedented pace. With each passing day, cryptocurrency is making headway into mainstream commerce, finance, and indeed, our daily lives. This article explores the latest trends, significant milestones, and the future outlook of cryptocurrency adoption across the globe. The Surge ...[Read More]

A Guide to Low-Cost Trading Platforms

Exploring Platforms With Low-Cost Trading Fees Exploring Platforms With Low-Cost Trading Fees In the landscape of modern investing, finding platforms that offer low-cost trading fees is akin to discovering hidden gems. As more individuals look towards investing as a means to grow their wealth, the importance of minimizing expenses cannot be understated. This article delves into some of the leading...[Read More]

Effective Risk Management Strategies for Traders

Implementing Risk Management in Trading Risk management is a critical component of successful trading. It allows traders to manage their exposure to losses and enhances their ability to make informed decisions under varying market conditions. This article outlines the key strategies and principles involved in implementing effective risk management in trading activities. Understanding Risk Manageme...[Read More]

Maximize Benefits with Credit Card Rewards Programs

Ultimate Guide to Credit Card Rewards Programs Credit card rewards programs are designed to offer incentives to customers for using their credit cards for purchases. These rewards can come in various forms, including cash back, points, or miles, and can significantly enhance the value you get from your credit card. With the myriad of options available, understanding the nuances of these programs c...[Read More]

Strategies for Investing in Technology Stocks

# Navigating the Tech Stock Market: Strategic Investment Tips Investing in technology stocks can be both exhilarating and daunting due to the sector’s potential for high growth and, conversely, high volatility. Understanding the landscape and adopting a strategic approach can help navigate through the complexities of the tech market. Below are insights and tips for both novice and seasoned i...[Read More]

Mastering Investment Risk Management: A Guide

Understanding Investment Risk Management Investment risk management is a strategic process that helps investors protect their investment portfolios against adverse market conditions. It involves identifying potential risks, assessing their impact, and implementing strategies to mitigate or eliminate those risks. Effective risk management ensures that investors can achieve their investment goals wh...[Read More]

Guide to Finding Brokers with Best Exchange Rates

Brokers with Competitive Exchange Rates Brokers with Competitive Exchange Rates In the world of finance, foreign exchange rates—or forex rates—play a crucial role for investors, traders, and businesses engaged in international transactions. Finding brokers that offer competitive exchange rates can significantly impact profitability and cost-effectiveness. This article will guide you through unders...[Read More]