Technical Analysis

Welcome to the Technical Analysis section of Valifind.com, your go-to source for insights and strategies to help you navigate the financial markets with precision and confidence. Is a crucial tool for traders and investors looking to make data-driven decisions. At Valifind.com, we provide in-depth analysis, charts, and expert commentary to help you understand market trends, price movements, and potential trading opportunities. Whether you’re a beginner or a seasoned trader, our section is designed to enhance your trading skills and maximize your investment returns. Understanding – is essential for anyone serious about trading or investing. By analyzing price patterns, volume, and other market data, technical analysis helps predict future market movements and identify potential entry and exit points. Our team of experienced analysts at Valifind.com offers a wealth of knowledge to help you grasp the fundamentals and advanced techniques of technical analysis. We focus on practical, actionable insights that you can apply directly to your trading strategies, ensuring you stay ahead of market trends and make informed decisions.

Understanding Volume Analysis Techniques in Trading

Introduction to Volume Analysis Techniques Volume analysis is a key technique used to assess the strength of market trends and identify potential reversals. It involves the examination of the number of shares or contracts traded within a specific period. The basic premise is that volume precedes price. Hence, any major changes in trade volumes can indicate a significant change in market sentiment....[Read More]

Exploring Algorithmic Strategies in Technical Market Analysis

Algorithmic Strategies in Technical Analysis Technical analysis is a critical tool for predicting future price movements based on historical data. Over the years, algorithmic strategies have been incorporated into the process to improve accuracy, efficiency and speed. These strategies use complex mathematical models to analyze market trends and make investment decisions. This article will delve de...[Read More]

Mastering Support and Resistance Trading Strategies

Understanding Support/Resistance Trading Strategies Introduction to Support/Resistance Trading Support and resistance trading is a fundamental approach used by traders to predict future market trends and price levels. This strategy is based on the concept that the market tends to bounce back from previous highs and lows, creating what is known as support and resistance levels. Understanding these ...[Read More]

Guide to Using Moving Averages for Effective Trend Analysis

Using Moving Averages for Trend Analysis Introduction When it comes to analyzing market trends, one of the most popular and effective tools used by traders and investors is the moving average. Moving averages are used to identify and confirm trends, providing valuable data that can help in making strategic investment decisions. This article will delve into the concept of moving averages and how th...[Read More]

Exploring Advanced Candlestick Patterns in Trading

Advanced Candlestick Patterns Candlestick charts are a technical tool that packs data for multiple time frames into single price bars. This makes them more useful than traditional open-high, low-close bars or simple lines that connect the dots of closing prices. Candlesticks give visual cues that make reading price action easier. This article will delve into advanced candlestick patterns that trad...[Read More]

Understanding Trend Analysis Using Moving Averages

Introduction In the world of business, finance, and economics, trend analysis plays a vital role in decision-making processes. It involves the use of statistical techniques to identify patterns or trends in data over time. One of the commonly used methods for trend analysis is the Moving Average. This article aims to provide a comprehensive understanding of trend analysis using moving averages. Wh...[Read More]

Utilizing Dow Theory Principles in Today’s Market Analysis

Applying Dow Theory to Modern Markets Introduction to Dow Theory The Dow Theory, named after Charles H. Dow, one of the founders of The Wall Street Journal and the Dow Jones Company, is a fundamental framework used to analyze and understand market behavior. It was developed in the late 19th century and is still widely used by traders and investors today. The theory is based on six basic tenets tha...[Read More]

Mastering Trading Strategies: An Insight into MACD Crossovers

Introduction to MACD and its Crossovers The Moving Average Convergence Divergence (MACD) is a popular trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A nine-day EMA of the MACD, called the “signal line,” is ...[Read More]

Decoding Market Cycles: A Comprehensive Guide

Introduction to Market Cycles Market cycles, also known as economic cycles, are a fundamental concept in economics and investing. They refer to the natural and inevitable fluctuations in the economy between periods of expansion (growth) and contraction (recession). Understanding market cycles is crucial for investors, business owners, and policymakers as it helps them make informed decisions. Phas...[Read More]

Mastering Bollinger Bands: A Comprehensive Guide for Traders

Introduction to Bollinger Bands Bollinger Bands are a technical analysis tool developed by John Bollinger in the 1980s. They are used primarily in trading to measure the ‘highness’ or ‘lowness’ of the price of a security relative to previous trades. Bollinger Bands consist of a middle band with two outer bands. The middle band is a simple moving average, while the outer ban...[Read More]

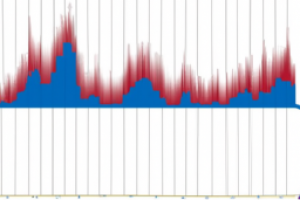

Understanding and Interpreting the MACD Histogram for Trading

Introduction to MACD Histogram The Moving Average Convergence Divergence (MACD) Histogram is a popular tool among technical analysts and traders. The MACD Histogram is used to forecast price trends and potential buy and sell signals. It is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. Understanding the MACD Histogram The M...[Read More]

Mastering Harmonic Trading Patterns for Effective Market Predictions

Introduction to Harmonic Trading Patterns Harmonic trading is a sophisticated method of technical analysis that leverages the recognition of specific price structures and the alignment of exact Fibonacci ratios to identify highly probable reversal points in the financial markets. This approach assumes that trading patterns or cycles, like many patterns in life, repeat themselves. The key idea is t...[Read More]