Introduction to Moving Averages in Trend Analysis

Moving averages are crucial tools used in trend analysis, allowing traders and analysts to understand market directions by smoothing out price data over a specified period. These averages help in identifying the direction of the trend and in making predictions about future price movements. This article dives into how moving averages can be employed effectively for trend analysis, covering various types of moving averages and practical steps to analyze trends.

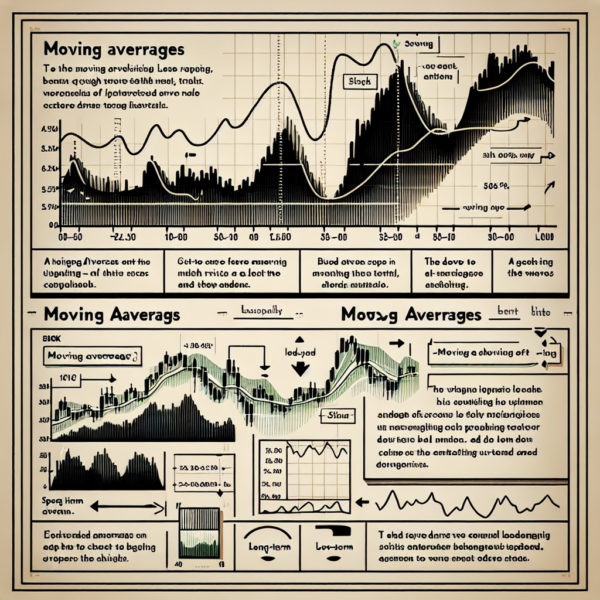

Understanding Moving Averages

At its core, a moving average (MA) is a statistical calculation used to analyze the data points by creating a series of averages of different subsets of the full data set. In financial markets, these are typically calculated based on the closing prices of securities over a specific time period. Moving averages are dynamic, as they change and ‘move’ with each new data point.

Types of Moving Averages

There are several types of moving averages, each with its unique calculation method and utility:

- Simple Moving Average (SMA): The SMA is calculated by summing up the prices of a security over a certain number of periods and then dividing this total by the number of periods.

- Exponential Moving Average (EMA): The EMA gives more weight to recent prices in an attempt to make it more responsive to new information. This makes the EMA quicker to react to price changes than the SMA.

- Weighted Moving Average (WMA): The WMA is similar to the EMA but allows the user to assign specific weights to each price point, making it customizable based on the analyst’s preferences.

Applying Moving Averages for Trend Analysis

Moving averages can be an indispensable part of a trader’s toolkit for trend analysis. Here’s how one can apply them effectively:

Identifying the Trend

The most straightforward use of a moving average is to determine the market trend. If the price of a security is above its moving average, it’s generally considered to be in an uptrend, and if it’s below, in a downtrend. The slope of the moving average also gives clues about the trend’s strength.

Using Multiple Moving Averages

Employing multiple moving averages of different lengths is a popular strategy among traders. For instance, using a combination of a short-term and a long-term moving average can provide signals for potential bullish or bearish crossovers.

- Bullish Signal: When a short-term MA crosses above a long-term MA, it may indicate the beginning of an uptrend.

- Bearish Signal: Conversely, when a short-term MA crosses below a long-term MA, it might suggest the start of a downtrend.

Support and Resistance Levels

Moving averages can also act as levels of support or resistance. In an uptrend, a moving average might serve as a support level that the price might bounce off from. In a downtrend, it could act as a resistance level that the price may struggle to break above.

Practical Steps for Using Moving Averages in Trend Analysis

Here’s a simple guideline on how to employ moving averages for trend analysis:

- Choose the type of moving average to use (SMA, EMA, or WMA) based on your analysis needs.

- Select the appropriate time period (such as 50-day, 100-day, or 200-day MA) depending on the investment horizon and strategy.

- Apply the moving average(s) to your price chart.

- Observe the moving average’s slope, and its relationship to the price to identify the trend direction.

- Look for crossover events between short-term and long-term moving averages for potential entry or exit signals.

- Monitor how the price interacts with the moving average lines to identify possible support or resistance areas.

Conclusion

Moving averages are a powerful and versatile tool in trend analysis. Whether you’re a seasoned trader or just starting, understanding how to use moving averages effectively can provide deep insights into market trends, helping to make informed trading decisions. Remember, no analytical tool is perfect, and it’s often best to use moving averages in conjunction with other indicators and techniques for the best results.