Technical Analysis

Welcome to the Technical Analysis section of Valifind.com, your go-to source for insights and strategies to help you navigate the financial markets with precision and confidence. Is a crucial tool for traders and investors looking to make data-driven decisions. At Valifind.com, we provide in-depth analysis, charts, and expert commentary to help you understand market trends, price movements, and potential trading opportunities. Whether you’re a beginner or a seasoned trader, our section is designed to enhance your trading skills and maximize your investment returns. Understanding – is essential for anyone serious about trading or investing. By analyzing price patterns, volume, and other market data, technical analysis helps predict future market movements and identify potential entry and exit points. Our team of experienced analysts at Valifind.com offers a wealth of knowledge to help you grasp the fundamentals and advanced techniques of technical analysis. We focus on practical, actionable insights that you can apply directly to your trading strategies, ensuring you stay ahead of market trends and make informed decisions.

Interpreting the MACD Histogram for Effective Trading Strategies

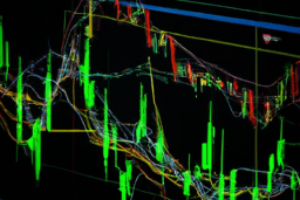

Introduction to MACD Histogram The Moving Average Convergence Divergence (MACD) histogram is a popular tool among traders and investors for identifying potential buy and sell signals in the market. Developed by Gerald Appel in the late 1970s, the MACD histogram is a graphical representation of the difference between the MACD line and the signal line. Understanding the MACD Histogram The MACD histo...[Read More]

Mastering Double Tops and Bottoms in Trading

Recognizing Double Tops and Bottoms in Trading Trading involves a deep understanding of market trends and patterns. One of the most common patterns that traders look out for are “double tops” and “double bottoms”. Recognizing these patterns can significantly improve your trading strategy and help you make more informed decisions. Understanding Double Tops The double top is ...[Read More]

Mastering Divergence for Effective Trading Strategies

Introduction to Divergence in Trading Strategies Divergence in trading refers to a discrepancy between the price action of an asset and a related indicator or other measure of market direction. This is often interpreted as a sign that the current trend in the price may be weakening, potentially signaling a reversal. Divergence can be a powerful tool in a trader’s arsenal, especially when com...[Read More]

Understanding and Applying Fibonacci Retracement in Trading

Introduction to Fibonacci Retracement Fibonacci retracement is a popular tool used by technical traders and is based on certain key numbers identified by mathematician Leonardo Fibonacci in the 13th century. However, Fibonacci’s sequence of numbers is not as important as the mathematical relationships, expressed as ratios, between the numbers in the series. In technical analysis, these ratio...[Read More]

Mastering the Art of Market Timing with Oscillators

Introduction to Oscillators and Market Timing In the realm of technical analysis, oscillators play a pivotal role in predicting market trends and making informed trading decisions. These tools are designed to provide insight into potential market reversals by comparing various price data points. Market timing, on the other hand, is a strategy that involves making buy or sell decisions by attemptin...[Read More]

Understanding and Interpreting Ichimoku Cloud Trading Signals

Introduction to Ichimoku Cloud Trading Signals The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a versatile trading indicator used to identify market trends, support and resistance levels, and generate trading signals. Developed by Goichi Hosoda in Japan, it offers a unique perspective on trading opportunities by combining several indicators into one charting technique. The term “Ich...[Read More]

Mastering Momentum Trading: A Guide to Using Oscillators

Momentum Trading with Oscillators Trading in the financial markets is a complex activity that requires a deep understanding of various strategies and indicators. One such strategy is momentum trading, which involves buying and selling securities based on their recent price trends. Oscillators are technical tools that traders use to identify potential trading opportunities. This article explores ho...[Read More]

Decoding Volume Spikes and Market Reversals in Stock Trading

Introduction to Volume Spikes and Market Reversals Understanding the dynamics of the stock market can be a daunting task. However, there are certain indicators that can provide valuable insight into market trends and potential reversals. Two of these indicators are volume spikes and market reversals. These two concepts are closely intertwined and can provide a wealth of information for both novice...[Read More]

Decoding Overbought and Oversold Conditions in Market Analysis

Understanding and Analyzing Overbought and Oversold Conditions Introduction Investing in the financial market requires a deep understanding of market trends, stock performance, and economic indicators. Among these crucial elements, the concepts of overbought and oversold conditions play a significant role. These terms are frequently used in technical analysis to determine the best time to buy or s...[Read More]

Exploring RSI Strategies for Effective Market Analysis

RSI Strategies for Market Analysis Market analysis is a critical component of successful investing. One of the most popular tools used by traders and investors alike is the Relative Strength Index (RSI). The RSI is a momentum oscillator that measures the speed and change of price movements. This article will explore RSI strategies for market analysis, providing a comprehensive guide on how to effe...[Read More]

Understanding Sentiment Indicators for Market Predictions

Introduction to Sentiment Indicators Sentiment indicators are essential tools used by investors and traders to gauge the overall mood of the market. They provide valuable insights into the collective attitudes of market participants towards the financial markets. These indicators can be used to predict potential market movements, helping traders make informed investment decisions. The Role of Sent...[Read More]

Understanding and Utilizing Moving Averages in Trend Analysis

Using Moving Averages for Trend Analysis Introduction Trading in the financial markets involves a lot of analysis and interpretation of market trends. One of the most common and effective ways to do this is by using moving averages. A moving average is a statistical analysis tool that smooths out price data by creating a constantly updated average price. This is particularly useful in identifying ...[Read More]